AI in Banking: Should I Build or Should I Buy?

OpenAI's CFO, Sarah Friar, made it clear at Money20/20: AI is here; it's "happening right now! If you think it’s experimental, it’s not... Whoever you are, it matters to you now."

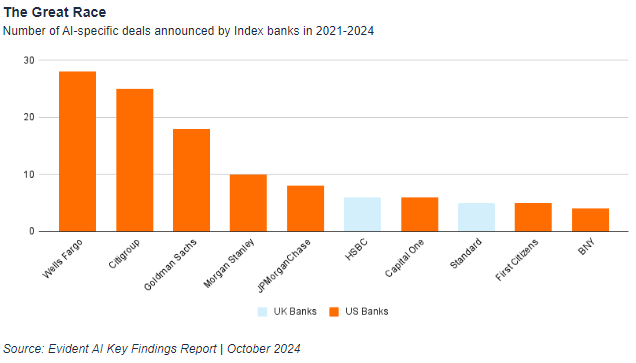

For financial institutions (FIs), the question isn't if they'll embrace AI, but how. With nearly 60% of small and medium-sized financial services providers already working with AI vendors and large banks increasing AI-related hiring by 17% YoY, the question isn’t if FIs will adopt AI. Rather, it’s whether they will build their own solutions or buy them from external vendors.

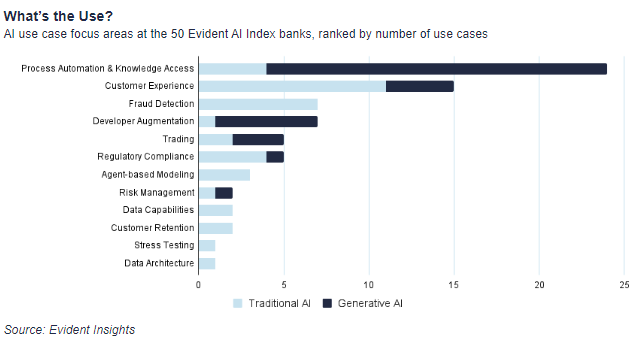

The build-versus-buy debate hinges on the value of proprietary data and customization needs. At Money20/20, financial leaders from institutions like Citi, Mastercard, TSYS, and Capital One highlighted their litmus test for building vs. buying: will their FI's proprietary data substantially improve the AI solution? If the answer is no, these FIs often prefer to buy, unless security concerns demand an in-house build.

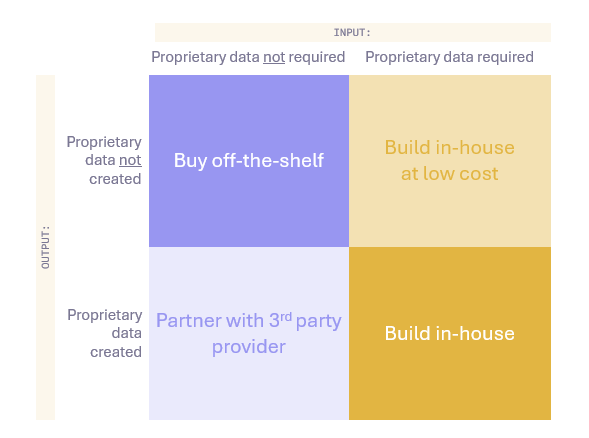

However, FIs need to value both the data going in and coming out of an AI solution. It's understood that if an FI's proprietary data significantly enhances the AI solution, building in-house can provide a competitive edge by safeguarding sensitive data and avoiding shared benefits with competitors. However, some FIs are also considering the data coming out of an AI solution. Even if input data isn't highly proprietary, the potential for an AI solution to create high-value output data can make partnerships a more attractive option (see Exhibit 2).

Large banks are investing heavily in internal teams. Evident Insights identified 70K employees in 200 AI-related roles across 50 banks, noting a 17% YoY increase in AI headcount. Growth is particularly strong in areas like AI-specific software implementation (+37% YoY) and AI model risk (+18% YoY), with data engineering and AI development remaining the largest talent segments (Exhibit 3).

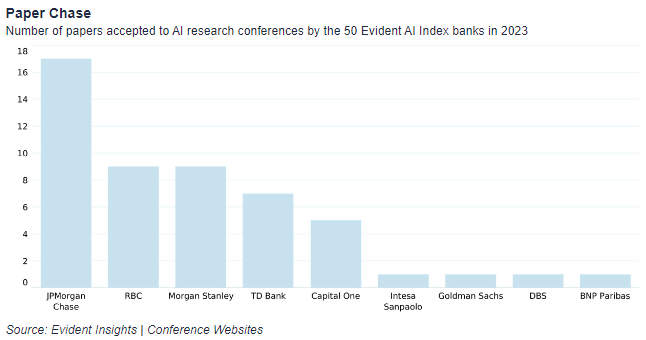

These internal teams are making significant contributions to AI research. JP Morgan Chase leads with 17 papers accepted at AI research conferences, followed by RBC, Morgan Stanley, and TD Bank (Exhibit 4). This demonstrates a commitment to developing in-house expertise.

FIs building in-house AI solutions are partnering directly with large language model (LLM) providers. Morgan Stanley has been working with OpenAI to roll out homegrown solutions, including AI knowledge assistant tools for financial advisors and AI-powered meeting summarization. BNP Paribas signed an agreement with Mistral AI, while TD Bank said it was working with Cohere.

For other use cases, off-the-shelf solutions are good enough? Goldman Sachs, for instance, deployed Microsoft’s GitHub Copilot firm-wide for AI-assisted coding. However, some of these "off-the-shelf" solutions are turning out to require a lot of hand-holding, leading some CIOs to question the ROI given their high price tags.

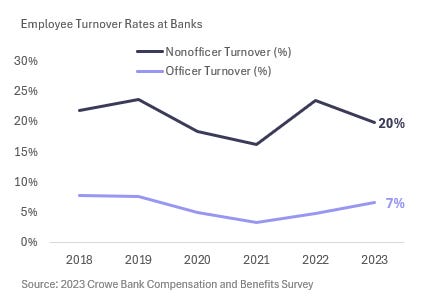

The most significant roadblock to building in-house is talent retention. Large FIs are investing heavily in hiring AI talent. However, banks' non-officer employee turnover rates have historically been ~20% (Exhibit 6). Given the intense competition over AI talent, FIs can't afford to experience similar churn rates in their tech teams.

The elephant in the room is that not all FIs even have the resources for in-house AI development. Smaller institutions may opt for third-party software even when proprietary data is involved, acknowledging their resource constraints.

Selling to the long tail of FIs requires sequencing. In a recent lunch, Nik Milanović from This Week in Fintech noted that FIs move at different paces. Some FIs like Bankwell Bank, which is partnering with Casca, are early adopters, driven by the perceived threat from incumbents and disruptors. Others prefer to wait until providers integrate with core banking partners to adopt new solutions. Still, others will wait until core banking providers acquire these third-party providers to enroll.

Ultimately, whether to build or buy AI depends on each bank’s resources, strategic goals, and the sensitivity of their data. Large institutions with ample data and talent may benefit from building in-house solutions for competitive differentiation. Smaller banks, in contrast, gain scalability and efficiency by relying on vendor-provided AI solutions, making partnerships a practical path to AI adoption.